The Auditor General’s report raises key issues to be considered by the NSW Housing Inquiry and those making submissions.

DAVID WHITE

The NSW parliament is currently conducting an inquiry into social, public and affordable housing, noting the recommendations of the 2013 report of the Audit Office of New South Wales entitled Making the best use of Public Housing.

Some of the conclusions of the Report which underpins the Inquiry stated:

- It is estimated that all social housing only meets 44 per cent of need in New South Wales.

- Housing NSW (HNSW) projected that for social housing to continue to meet the same level of need (i.e. 44 per cent of need) in 2021 it would require an additional 2,500 social housing dwellings per annum and cost more than $9 billion over 10 years.

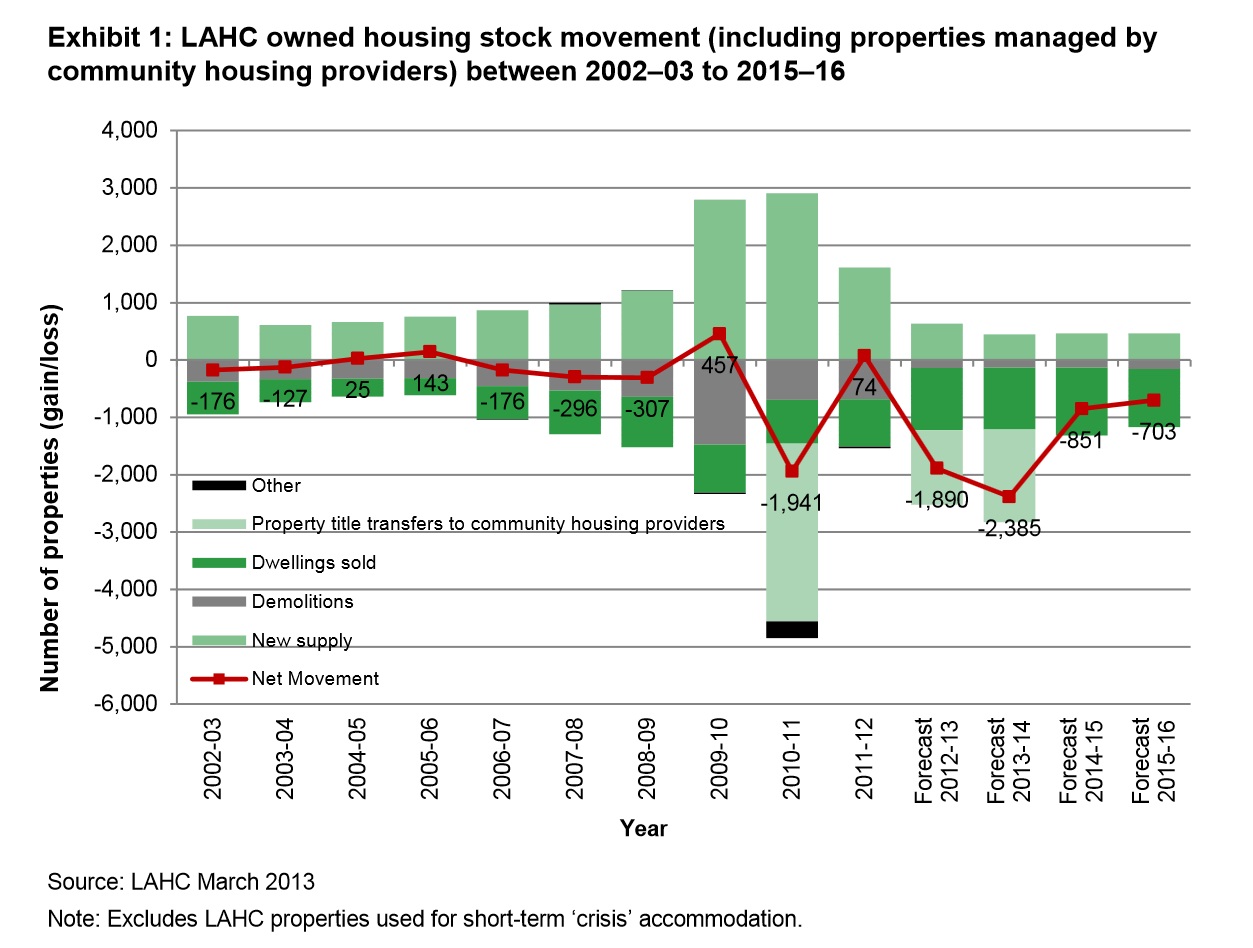

- Land and Housing Corporation (LAHC) has been disposing of more properties than it has added in recent years (except during the National Economic Stimulus Building years 2009 to 2012). LAHC sells public housing properties to meet operating cost shortfalls, disposing of properties each year. LAHC reported that from 2003-04 to 2011-2012 the sale of over 5,500 dwellings has raised $1.2 billion, and projects that it will be disposing of more than double the number of properties it builds over the next four years (see table below showing net movement of LAHC owned stock).

- While the housing stock reduces, the number of potential tenants increases. The waiting list is projected to grow by 60 per cent, to more than 86,000 by 2016

- Public housing is ageing and increasingly not fit for purpose. The total cost of public housing per dwelling is now almost 50 per cent higher than in 2001-02. Although there is an ageing portfolio with its associated increased need for repairs and maintenance, overall the annual maintenance expenditure has dropped over the last decade

- LAHC’s public housing portfolio was worth approximately $32 billion in 2012 and could have notionally generated market rent income of around $1.5 billion. However, nearly $860 million was forgone to fund rental rebates to public housing tenants.

- Public housing rents are pegged to between 25 to 30 per cent of the income levels of their tenants, most of whom receive benefit payments through Centrelink. At June 2011, 94 per cent of public housing subsidised tenants received a Centrelink benefit as their main income, with only five per cent receiving wages as their main income source

- LAHC reports that a continuation of current strategies will see the portfolio decline over time in terms of dwelling numbers and standard. This will have a negative impact it suggests by increasing the level of complaints about the standard of public housing. Without change, it is likely that public housing will either run down or be sold off.

- There are fundamental questions about the future of public housing that need to be resolved so that appropriate, long-term strategic planning can be effective. These include:

-

- With demand outstripping supply to such an extent, what are the priorities for housing people while remaining sustainable both financially and socially?

- What is the appropriate model of ownership, LAHC or community housing providers or a mix, and if so, what is the best mix?

- With costs growing and revenue declining, can revenue be increased?

These are some of the big issues the Inquiry should address. Details on how you can make a submission and have your voice heard can be found in Select Committee on Social, Public and Affordable Housing!

David White is the Tenant Participation Resource Services (TRPS) Worker at ISRC.

Originally published in Inner Sydney Voice Issue 119 Autumn 2014